The OBBBA’s Ripple Effect: What it Means for SALT Policy

- Contributor

- Mac Smith

Sep 3, 2025

The One Big Beautiful Bill Act (OBBBA) will likely go down in history as one of President Trump’s most impactful policy bills.

The OBBBA addressed many things, but the tax policy changes are the ones we want to talk about today. Specifically, we want to unpack how those federal tax policy changes could impact state and local tax planning for individuals and business owners.

In this article, we’ll answer the following questions:

- What is the One Big Beautiful Bill Act?

- What tax changes are in the One Big Beautiful Bill Act?

- How might the One Big Beautiful Bill Act affect state taxes?

- What other state tax angles deserve attention?

What is the One Big Beautiful Bill Act?

The OBBBA is a sweeping budget reconciliation package that President Trump signed into law on July 4, 2025. It includes provisions on healthcare funding, green energy programs, workforce investment, infrastructure spending, SNAP benefits, border security, and taxes for both individuals and businesses.

What tax law changes are in the One Big Beautiful Bill Act?

The OBBBA made many tax law changes, but one stands out above the rest: it permanently extended most of the temporary tax provisions that were in the TCJA.

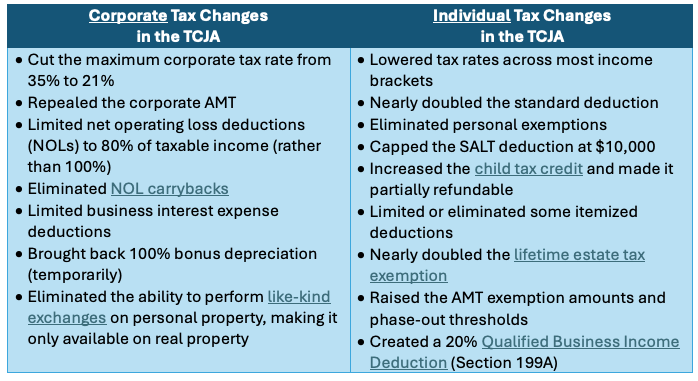

In 2017 — during President Trump’s first term — lawmakers introduced the Tax Cuts and Jobs Act (TCJA). The TCJA overhauled the tax code in the following ways:

While the corporate tax provisions were permanent additions to the tax code, most of the individual tax provisions were set to sunset (or expire) at the end of 2025.

The OBBBA changed that by making nearly all the individual tax provisions in the TCJA permanent. For a breakdown of which provisions changed under the OBBBA (and for information about new tax provisions passed with the OBBBA), see this comparison chart.

How might the One Big Beautiful Bill Act affect state taxes?

The OBBBA is a federal tax law; it doesn’t have the power to change state tax law. However, there are a couple of provisions in the OBBBA that could have a ripple effect on state taxes and state tax planning.

SALT deduction cap and the staying power of PTETs

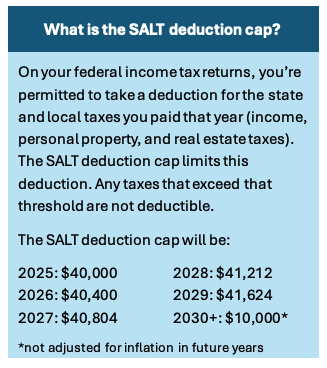

The OBBBA changed the SALT deduction cap in two ways. First, it made the $10,000 cap permanent. Second, it temporarily boosted the cap to $40,000 for tax years 2025 through 2029 (adjusted for inflation beginning in 2026). This means that more of your state and local taxes could be deductible — at least in the next five years. This could steer business owners of pass-through entities away from considering pass-through entity tax (PTET) strategies.

We go into detail about PTETs here, but in summary, PTETs were created as a workaround for the SALT deduction cap. A PTET election effectively transforms an individual tax deduction (which is limited) into a business tax deduction (which is unlimited).

While the expanded deduction could make PTET elections less vital in the coming five years, PTETs could still be beneficial for your entity, depending on:

- Your adjusted gross income: The full $40,000 SALT deduction cap is only available to taxpayers whose modified AGI is below a certain threshold. It begins to phase out (to a minimum of $10,000) as modified AGI increases.

- The availability of PTET credits: Not all states offer credits for PTET taxes paid on your behalf, which could result in double taxation.

- Your tax liability shifting goals: PTETs can be great tools to shift tax attributes between partners. If your partnership agreement allows special allocations, you may be able to shift PTET credits to specific partners, optimizing each partner’s tax position.

Whether or not you’d benefit from a PTET election today, it’s smart for you to explore your options now. The $10,000 SALT deduction cap is set to return in 2030, and at that time, PTETs may be your best option for getting a large state and local taxes deduction.

Bonus depreciation and qualified production property

The OBBBA restores and makes permanent 100% bonus depreciation for most property acquired after January 19, 2025. It also temporarily expands the availability of 100% depreciation to include a new category of property: qualified production property.

Qualified production property (QPP) is nonresidential real property (or a portion thereof) that is used in the manufacturing, production, or refining of tangible property into a product. Typically, these new facilities aren’t eligible for bonus depreciation. The OBBBA allows for QPP property to be fully deductible (under certain conditions), but only through the end of 2030.

Both the expanded bonus depreciation and the temporary allowance of 100% depreciation on QPP lead to more flexibility for business owners looking to acquire new or used property in the coming years.

But what does this have to do with state taxes?

All states treat bonus depreciation differently. Some states automatically conform to whatever the federal law is at that time (full conformity); other states are selective with which federal provisions they adopt (partial conformity); and others completely disregard federal rules (decoupling). Over the coming months, states will have to decide if they will conform with or decouple from the bonus depreciation provisions in the OBBBA. Depending on what they decide, state tax plans may need to change.

What other state tax angles deserve attention?

State taxes are complex. Each state is different, and laws change often. This makes state tax planning essential, especially for businesses that operate in more than one jurisdiction.

And income tax planning is only one piece of the puzzle. Sales tax laws change even more frequently than income tax laws. In fact, we’ve seen state sales tax laws change drastically in recent years as states respond to the groundbreaking South Dakota vs. Wayfair decision. Reach out to your CRI advisors to discuss state tax planning — for income, sales, estate/inheritance taxes, etc. — so that we can help you get ready for 2026.