Calculating Your Business Interruption Loss

Sep 26, 2025

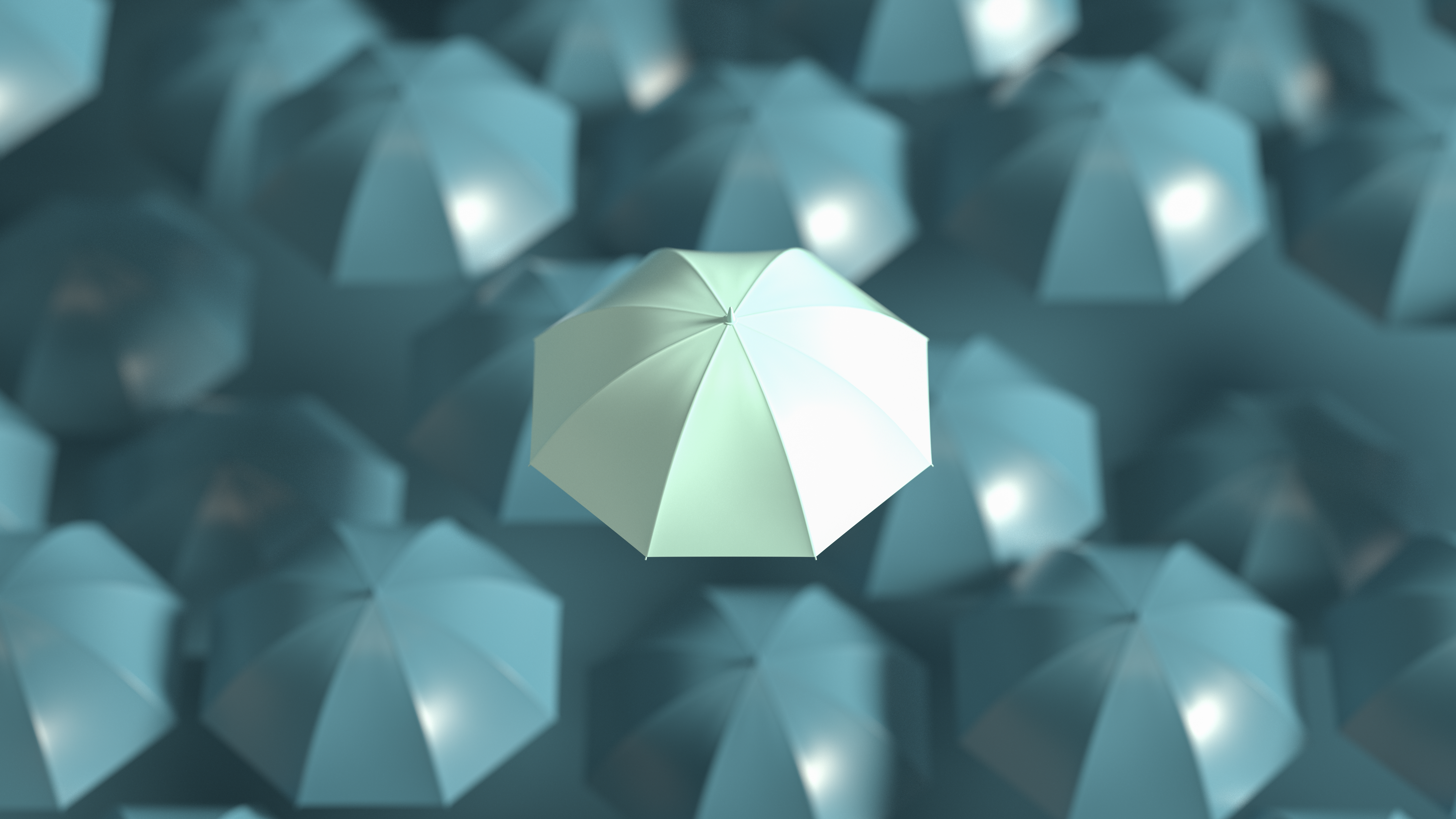

If your business has been affected by a disaster, it is imperative to focus on the steps you can take to protect and help your business recover.

To understand business interruption loss (BIL) calculations, you will need to calculate lost revenue, lost profit, and business insurance losses.

Lost Revenue

Lost revenue is determined by subtracting actual revenue from but-for revenue.

But-for revenue is an estimate of revenue the business would have earned if the loss event had not occurred. There are generally four recognized methods and various other factors to consider, such as seasonality, growth and trends, and other outside factors.

Actual revenue represents revenues between the loss date and the date a business resumes “normal operations.” The period between the loss date and when operations can initially resume will typically have little to no revenue. In addition, actual revenue may include income during the recovery or “ramp-up” period, which is the period between the date the business resumes normal operations and the date business income recovers to the level it would have before the event.

Lost Profit

To calculate lost profit, businesses need to determine their avoided costs, which are subtracted from lost revenue.

Avoided costs are the ones that the business would have incurred in connection with the generation of its projected lost revenues. Such costs vary directly or indirectly with revenue and generally include the following:

- Direct costs are expenses that a business incurs to generate revenue--for example, the incremental cost to produce each “widget.” These expenses are often referred to as “cost of goods sold.”

- Variable (or “saved”) expenses are expenses the insured would incur but does not have to incur and therefore “saves” as a result of the loss event. These could include temporary labor, certain types of supplies, variable portions of franchise fees or rent, postage, or utilities.

Extra Expenses

The last step in determining the BI losses is to identify any extra expenses,which are those expenses incurred during the period of restoration. These incurred expenses help to avoid or minimize the suspension of the business. They may also allow the business to continue operations at their original location or a replacement or temporary location.

Calculating Business Interruption Loss

But-For Revenue

(—) Actual Revenue

_______________

= Lost Revenue

(—) Avoided Costs

_______________

= Lost Profit

(+) Extra Expenses

_______________

= BI Loss

Need Help With Your BIL Calculation?

While the information above provides a high-level overview of the BIL calculation, the calculation for specific BIL claims will always vary by policy. They are, by nature, estimates and thus are subject to the judgment of the professional calculating the loss. For additional assistance with your particular claim and support with your BIL calculation, please contact your CRI advisor. Having an experienced advisor by your side can help ensure your calculation is both accurate and defensible, giving you greater confidence in the claims process.